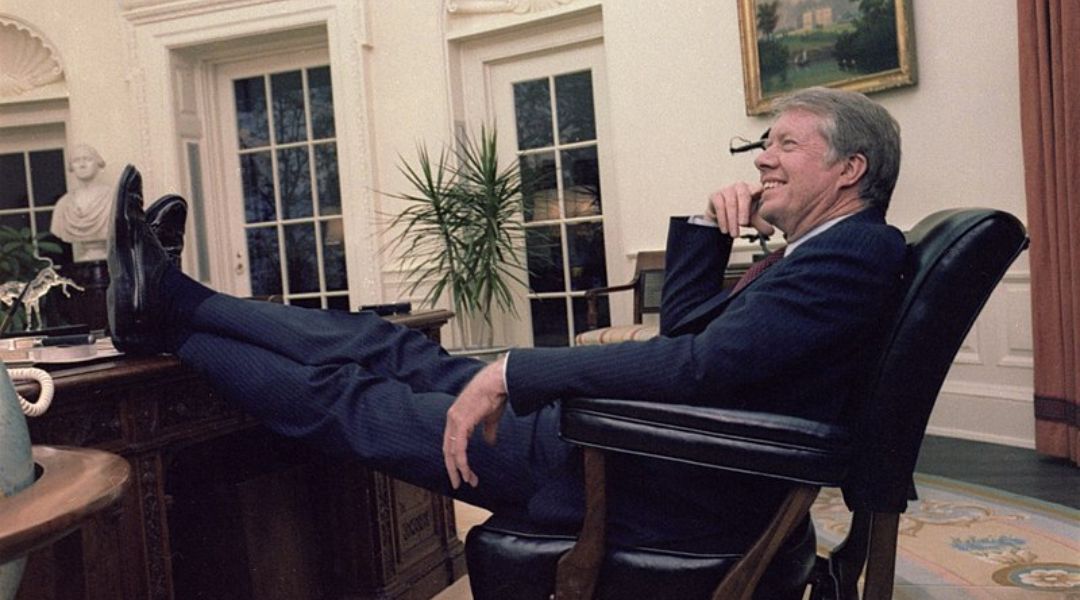

Tuntematon, Valkoisen talon valokuvaajat (01/20/1977 - 01/20/1981), Public domain, via Wikimedia Commons

Joe Biden has been dogged by comparisons to Jimmy Carter throughout his Presidency.

One of the biggest problems from the 1970s could rear its ugly head.

Now Joe Biden is staring down one major problem that spelled doom for Jimmy Carter.

President Joe Biden and his allies in the media claim that the economy has turned a corner in its fight with inflation.

The conventional wisdom is that the Federal Reserve successfully pulled off a soft landing of lowering inflation by raising interest rates without sending the economy into a recession.

JPMorgan Chase warns that 1970s-style stagflation is coming

Everything isn’t as rosy with the economy as the White House and media claim, according to JPMorgan Chase chief market strategist Marko Kolanovic.

In a note to the bank’s clients, he predicted the economy was going to head into stagflation last seen in the 1970s under former President Jimmy Carter.

“Going back to the question of market macro regime, we believe that there is a risk of the narrative turning back from Goldilocks towards something like 1970s stagflation, with significant implications for asset allocation,” Kolanovic wrote.

Stagflation is a deadly combination of high inflation and economic stagnation.

Economic growth grinds to a halt with soaring consumers and high levels of unemployment.

“The phenomenon ravaged the U.S. economy in the 1970s and early 1980s, as spiking oil prices, rising unemployment and easy monetary policy pushed the consumer price index as high as 14.8% in 1980, forcing Federal Reserve policymakers to raise interest rates to nearly 20% that year,” Fox Business reported.

Inflation could begin to rise again if the Fed cut interest rates during a recession.

“There are many similarities to the current times,” Kolanovic warned. “We already had one wave of inflation, and questions started to appear whether a second wave can be avoided if policies and geopolitical developments stay on this course.”

Economic analysts are becoming concerned after the last two inflation reports came in above predictions that inflation could be stuck at an elevated level.

Those reports made it unlikely that expected interest rate cuts from the Fed in the spring would happen.

Barack Obama’s best friend on Wall Street compares 2024 to the 1970s

JPMorgan CEO Jamie Dimon – a Democrat and ally of former President Barack Obama – said massive government spending, soaring budget deficits, and changing trade conditions in 2024 remind him of the 1970s.

In October, Dimon warned that “this may be the most dangerous time the world has seen in decades.”

1970s stagflation could turn Joe Biden into the first one-term Democrat President since Jimmy Carter.